Enjoy Smoother Invoicing and Faster Payments

Streamline your processes with structured digital invoices, faster payments, and automated efficiency through the Nationwide E-delivery network and Peppol standards

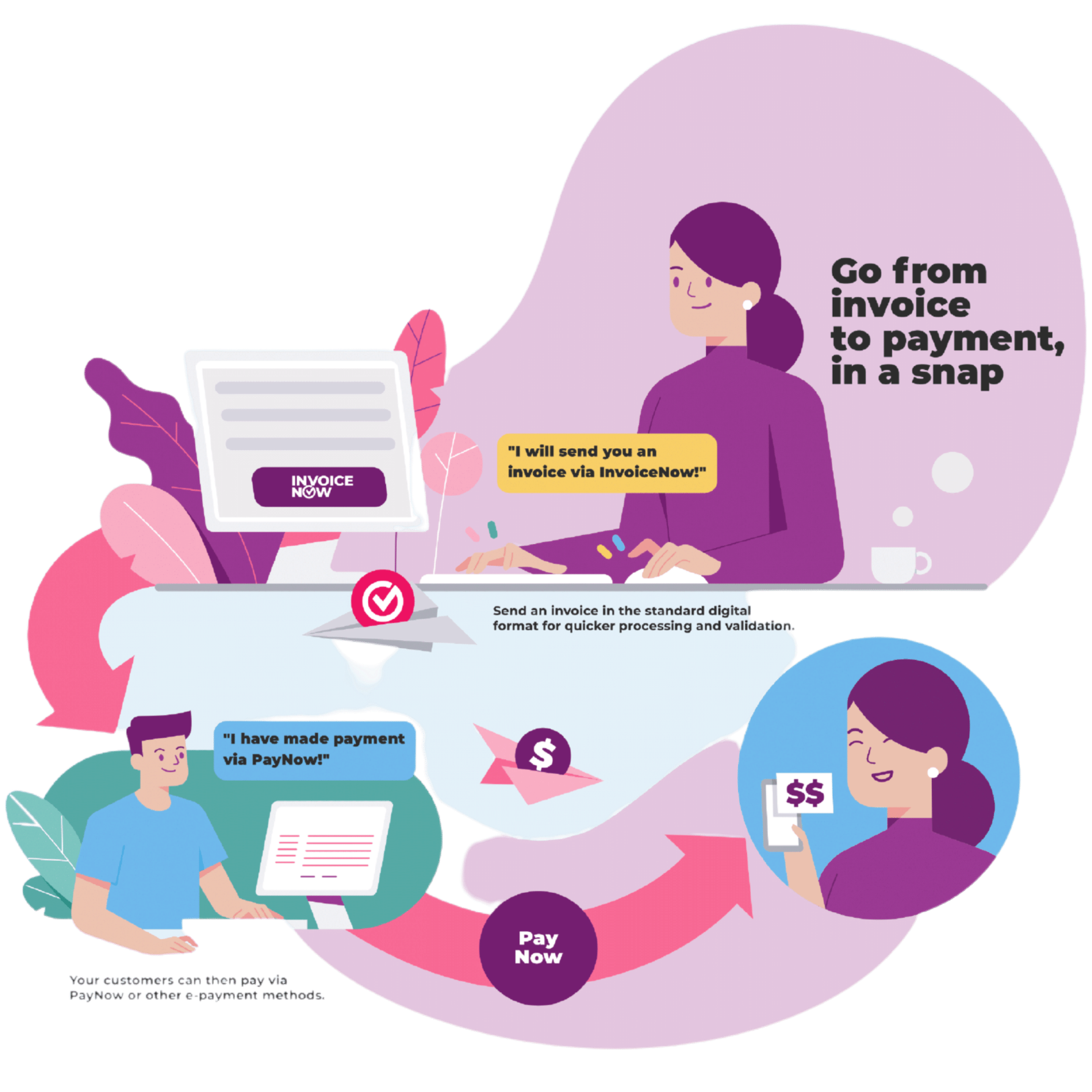

What is InvoiceNow?

Streamline e-document exchange between businesses with InvoiceNow,

the national E-invoicing solution powered by the Peppol network.

Seamlessly Crafted Professional Invoices

Craft polished invoices, estimates, and receipts effortlessly with Automa8e's Free Invoicing tool

Branded Invoices, Automated Reminders

Personalize invoices with your logo and branding; enjoy automated payment reminders for swift payments

Cloud-Powered On-the-Go Invoicing

Access invoices from anywhere through our cloud-based system, empowering on-the-go invoicing management

What Is Peppol?

A revolutionary international E-Document delivery network and business document standard for Electronic Data Interchange (EDI), enabling enterprises to effortlessly engage in digital transactions with connected companies across the global Peppol Network

Invoicing Made Simple

Automa8e's InvoiceNow enables secure, efficient e-invoicing via Peppol, seamlessly integrating with your accounting software for smooth transactions

Billing with Automa8e

Automa8e simplifies bill management with direct e-invoices, eliminating manual entry. Review and approve draft bills effortlessly on your laptop or app

Foster Timely Payments

Streamline payments by sending e-invoices via Automa8e, ensuring fast, efficient transactions with seamless approval and timely processing

Effective from 1st May 2025 for newly registered GST trader

GST INVOICENOW X AUTOMA8E

GST-registered businesses will be required to transmit invoice data to IRAS using InvoiceNow solutions via the InvoiceNow network

A soft launch will commence from 1 May 2025, allowing any existing GST-registered businesses that wish to be early adopters to transmit invoice data to IRAS using InvoiceNow solutions via InvoiceNow network

GST registered businesses that wish to be early adopters can adopt InvoiceNow solutions and start to transmit invoice data to IRAS.

Newly incorporated companies that voluntarily apply for GST registration are required to send invoice data to IRAS using InvoiceNow solutions.

All businesses that voluntarily apply for GST registration are required to send invoice data to IRAS using InvoiceNow solutions

Start Saving Time And Costs Today With Automa8e

Experience hassle-free accounting and compliances with Automa8e. Simplify your accounting workflows, save time and cut costs.