Automated

Tax Computation

Corporate Income Tax Returns

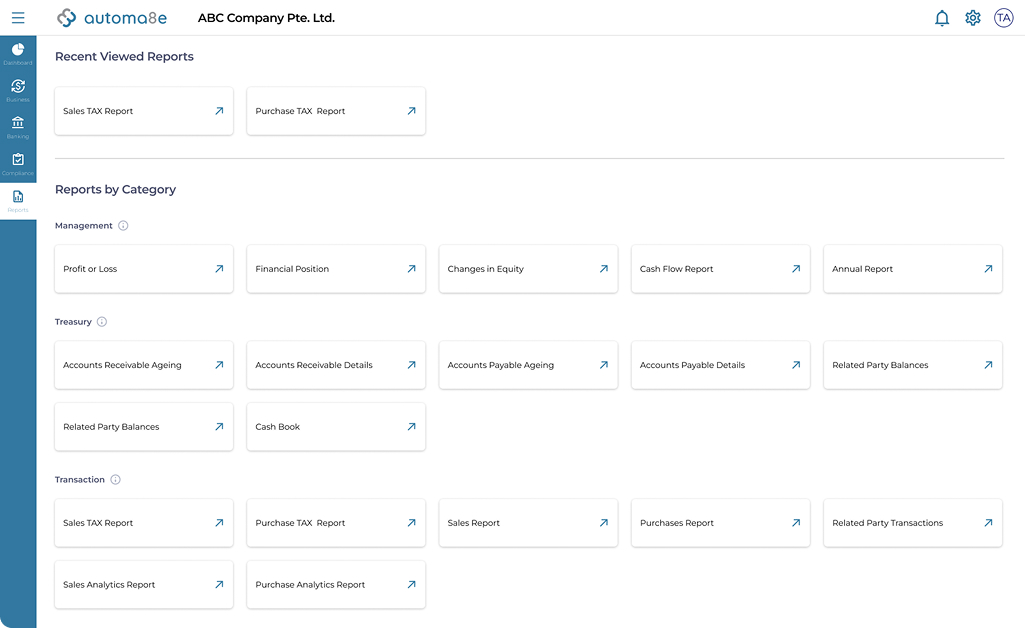

With taxoma8e, all tax computations for IRAS returns such ECI, Form C/Form CS are automatically computed for seamless submission to IRAS

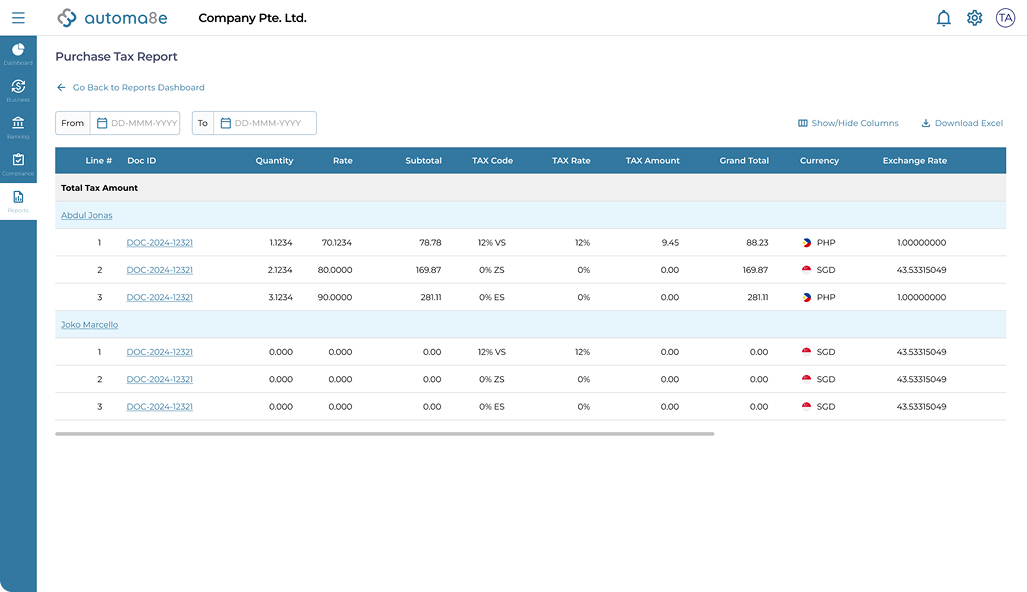

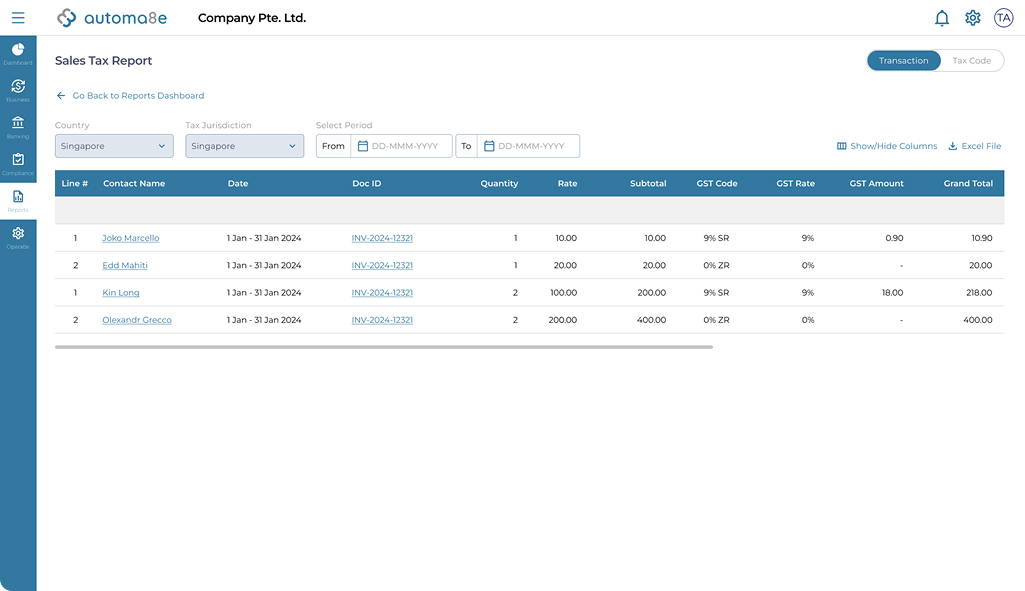

Regulatory GST computation

Using taxoma8e, users can proceed to generate autonomously Goods and Services Tax computations for IRAS seamless transmission

E-Invoicing and GST compilation

Taxoma8e’s e-invoicing function is in tandem with IRAS GST requirements from April 2025

Other Benefits

IRAS regulatory tax updates

Taxoma8e’s annual corporate and GST tax computations include the latest updated regulatory requirements from IRAS

Efficient tax return forms preparation

Automatic generation of tax return forms saves significant time and effort as data is captured autonomously from accountma8e into taxoma8e

Corner 5 requirements (coming soon)

Taxoma8e adopts GST requirements with e-invoicing functions as required by IRAS for newly GST registered traders

Start Saving Time And Costs Today With Automa8e

Experience hassle-free accounting and compliances with automa8e. Simplify your accounting workflows, save time and cut costs.